What are Machinery Loans?

Machinery loans are a type of business loan that can be used to buy new machines or upgrade existing equipment. Machinery loans help businesses overcome financial barriers, enabling them to scale operations without interruptions. With Ruloans, you can access machinery lending options from India’s top-tier banks, NBFCs, and financial institutions. Whether you need a loan for machinery purchase or machinery finance for upgrades, we ensure your business gets the best deal with higher loan amounts, attractive interest rates, and flexible loan tenures.

Features and Benefits of Machinery Loan

Eligibility Criteria for Machinery Loan

Applicant must be between 21 and 65 years of age

A credit score of 650 or higher

Minimum business vintage of 3 years

Machinery Loan Eligibility and Documents

Read on to know the criteria required to apply for our Car Loan.

Documentation Required for Machinery Loan

KYC Documents

Aadhar card, PAN card, driving license, passport, etc

Income tax returns (ITR) for the last 3 years.

Business ownership proof.

Proforma invoice of the machinery purchase.

Bank statements for the last 6 months.

Machinery Loan EMI Calculator

A Machinery Loan EMI Calculator is an online tool that helps borrowers calculate the Equated Monthly Installment (EMI) for a machinery loan. By inputting details such as the loan amount, interest rate, and loan tenure, the calculator provides an accurate estimate of the monthly payments, enabling businesses to plan their finances and manage cash flow effectively when investing in machinery.

Wide Range of Machinery & Equipment Financing Options that suit your Business Requirements

Medical Equipment Loans

Machinery Equipment Loan

Construction machinery finance

Manufacturing equipment loans

Farm machinery loans/finance

Aviation industry equipment loans

Used machinery loan

Loan Against Machinery

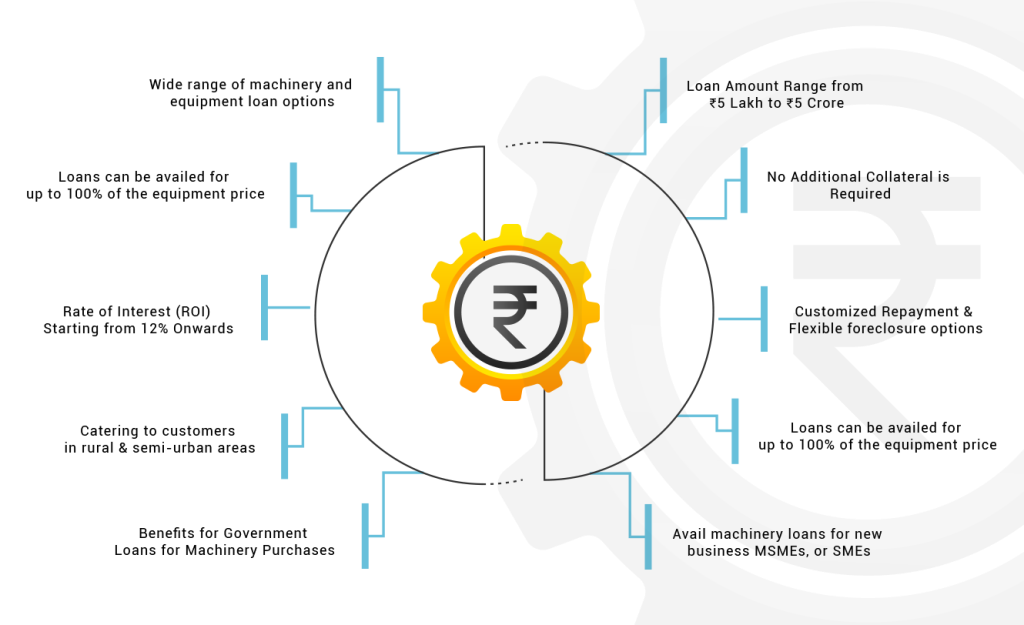

Features and Benefits of Machinery Loan

Loan Amount Range from ₹5 Lakh to ₹5 Crore:

Machinery loans provide businesses with access to substantial funding, allowing them to purchase essential equipment or upgrade their machinery. With a flexible loan range of ₹5 lakh to ₹5 crore, businesses of all sizes, from MSMEs to large enterprises, can find solutions tailored to their needs.

Rate of Interest (ROI) Starting from 12% Onwards:

Competitive interest rates starting at 12% ensure affordability, making it easier for businesses to manage repayments without straining their financial resources.

Tenure from 12 to 60 Months:

With flexible repayment tenure options ranging from 12 to 60 months, businesses can choose a schedule that aligns with their cash flow and financial planning.

Digital & Minimal Documentation:

The Machinery loan application process is hassle-free, with minimal documentation requirements and digital platforms simplifying the entire process. Businesses can save time and focus on their operations.

Loans can be availed for up to 100% of the equipment price

One of the standout features is that these Machinery Loans can finance up to 100% of the machinery’s cost, eliminating the need for a significant upfront investment.

Easy & Quick Disbursal

The streamlined approval and disbursal process ensures funds are quickly available, helping businesses avoid delays in machinery procurement.

Customized Repayment & Flexible foreclosure options

Borrowers can benefit from repayment options tailored to their financial situation. Additionally, flexible foreclosure policies allow early loan closure with minimal penalties, reducing the overall interest burden.

Avail machinery loans for new business MSMEs or SMEs

These Machinery loans are ideal for startups, MSMEs, and SMEs looking to establish or expand their operations, enabling them to invest in the latest technology and equipment.

No Additional Collateral is Required

Machinery loans often don’t require additional collateral, as the machinery itself acts as security. This reduces risk and ensures easier accessibility for small businesses.

Benefits for Government Loans for Machinery Purchases

Government-backed machinery loans often come with added benefits like subsidies or lower interest rates, encouraging businesses to modernize their equipment and improve productivity.

Catering to customers in rural & semi-urban areas

Special provisions ensure that even businesses in rural and semi-urban areas can access machinery loans, empowering regional entrepreneurs and fostering economic growth.

Upgrade your business operations effortlessly with our hassle-free machinery & equipment financing options.

Eligibility Criteria for Machinery Loan

Before applying for a machinery loan, it’s essential to determine whether you meet the required eligibility criteria. This step ensures a higher chance of approval and smooth processing. Here’s how you can check your eligibility for a machinery loan:

Age Requirement

- Verify that your age falls between 21 and 65 years.

- Applicants must meet this criterion at the time of loan application to qualify.

Credit Score

- Check your credit score through a reliable credit bureau or online credit report service.

- A score of 650 or higher is typically required to demonstrate financial discipline and good repayment history.

Business Vintage

Ensure that your business has been operational for at least 3 years.This demonstrates the stability and profitability of your business, a key factor for lenders. Additional Factors to Consider

- Annual turnover: Check if your business meets the lender’s minimum turnover requirement.

- Existing liabilities:Ensure that your debt-to-income ratio is manageable.

- Documentation:Verify that you have all necessary documents, such as proof of identity, address, business registration, and financial statements.

Tools to Simplify Eligibility Checks

Many financial institutions and loan providers offer online eligibility calculators on their websites. By entering details such as your age, credit score, and business information, you can get a quick estimate of your eligibility.

By evaluating these factors in advance, you can prepare a strong application and improve your chances of securing a machinery loan.

Machinery Loan Eligibility and Documents

Documentation Required for Machinery Loan

- Identity proof (Aadhar card, PAN card, driving license, passport, etc.).

- Address proof (Aadhar card, Ration card, Rent Agreement, utility bills, etc.)

- Income tax returns (ITR) for the last 3 years.

- Business ownership proof.

- Proforma invoice of the machinery purchase.

- Bank statements for the last 6 months.

Machinery Loan EMI Calculator

A Machinery Loan EMI Calculator is an online tool that helps borrowers calculate the Equated Monthly Installment (EMI) for a machinery loan. By inputting details such as the loan amount, interest rate, and loan tenure, the calculator provides an accurate estimate of the monthly payments, enabling businesses to plan their finances and manage cash flow effectively when investing in machinery.

0 INR

0 INR

Wide Range of Machinery & Equipment Financing Options that suit your Business Requirements

Medical Equipment Loans:

Medical Equipment Loans help healthcare providers acquire essential tools such as MRI machines, CT scanners, and diagnostic equipment. These Medical Equipment Loans are designed with flexible repayment options, allowing medical businesses to improve their services without significant upfront investments.

Machinery Equipment Loan:

Machinery Equipment Loans offer funding for industries such as manufacturing, construction, and engineering to purchase or upgrade essential machinery. By enabling businesses to acquire the latest machinery, these loans help maintain high productivity and operational efficiency.

Construction Machinery Finance:

Construction machinery finance provides the necessary funds for businesses to purchase heavy-duty equipment like bulldozers, cranes, and excavators. This Construction Machinery Finance option ensures that construction companies have the right equipment to avoid delays, enhance project execution, and increase overall productivity.

Manufacturing Equipment Loans:

Manufacturing equipment loans are tailored for businesses in the manufacturing sector, providing funds to purchase advanced machinery such as CNC machines and automated systems. These manufacturing equipment loans allow companies to scale operations, improve production quality, and stay competitive in their industries.

Farm Machinery Loans/Farm Machinery Finance

Farm machinery loans help farmers and agricultural businesses purchase equipment like tractors, harvesters, and irrigation systems. These farm machinery loans improve farming productivity, ensure timely harvests, and optimize agricultural operations.

Aviation Equipment Financing

Aviation Equipment Financing Solution provides funding to acquire necessary aviation equipment, such as aircraft engines and ground-handling machinery. This aviation equipment financing option helps aviation businesses maintain safety, comply with industry standards, and improve operational efficiency.

Used machinery loan

Used machinery loans enable businesses to purchase pre-owned equipment at a more affordable cost. This option is ideal for startups or small businesses looking to acquire high-quality machinery without the high expenses of purchasing brand-new equipment.

Loan Against Machinery

A loan against machinery allows businesses to leverage their existing equipment as collateral to access working capital. This loan against machinery option provides immediate liquidity, enabling businesses to meet operational needs or fund expansion projects without the need to sell valuable machinery.